Compare Payday Loans

Comparison sites have long been established in other financial sectors. These include insurance, mortgages and longer-term loans.We have compiled a list of active and reputable Financial Conduct Authority (FCA) approved short term lenders. All these companies can provide consumers with a loan based upon their own financial and personal circumstances.

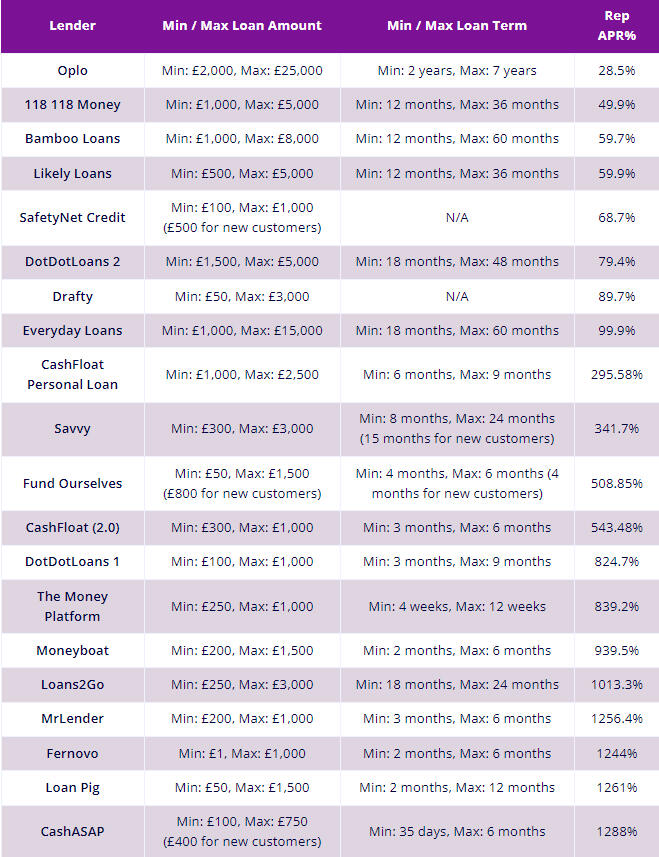

Short term loan comparison

To show you typical loan offers made by these companies, we have carried out some research, the goal of which is to allow you to compare payday lenders without necessarily having to make an application to one of them.As part of our research, we’ve compiled the following list of short-term credit providers in the UK. We have organised them by:loan amounts available

the length of time a consumer could pay back their loan

the representative APR offered

The table is sorted by Rep APR%, low to high - although you should note that you may not be accepted for the lowest APR deals as approval depends on your credit score and your personal financial circumstances. The best way of determining the lowest APR loan you are likely to be approved for, from our panel of 30+ lenders, is by clicking the button below and completing our short application form.

Why do you need to compare payday loan offers?

You need to compare payday loan offers to make a decision that’s informed and right for you.If you take out a short-term loan, you should do so responsibly. You should also be certain that you can meet your loan repayment obligations.It is important to perform a full payday loan comparison. This is because the cost of credit might be affordable from one payday company but not another.Without taking their time to find the right solution for you, you may end up paying more than you need to. What’s more, you could find yourself getting into financial difficulty later on.

What information should you consider before applying for a loan?

The important information you should consider before comparing payday loans is:how much you are going to pay back

when you have to pay it back

your credit score

whether it’s affordable for you.

High-cost credit options are not designed as a long-term financial solution.They are there to help out in emergency situations that you may not have budgeted for, like:a car breaking down

home repairs

replacing white goods for the home.

If you feel that you are in financial difficulty, you should contact the Money Advice Service or StepChange.Applicants for a payday loan should:

only borrow the exact amount of money they need for the situation they find themselves in

look at the pros and cons of any offers made by a lender so that they secure themselves the best deal for them.

Aspects to consider include the cost per £100 borrowed and any extra fees such as application fees, default fees or early repayment fees.It’s important to consider every potential and applicable charge involved in taking out money until the following payday.How do you know if a loan repayment is affordable?

You will know if a loan repayment is affordable if you can comfortably meet the repayments within your monthly budget. A monthly budget is for working out the spare cash you have after all your regular bills have been repaid.If you find meeting a repayment might put you in further financial difficulty, consider taking out a longer-term loan instead.While you will pay back more in interest over a longer-term loan, you will be able to afford the repayments without unnecessary hardship

What features make a payday loan best for you?

Features that make the best payday loan option are:Quick access to the cash required. Money is often transferred into a borrower’s accountant within minutes of the loan being approved and the paperwork having been signed

No hidden fees and charges. Under FCA rules, all fees and charges you may have to pay must be available in advance

Early repayment. Many payday lenders allow you to pay off your loan early. This means the amount you pay in interest for your loan decreases

Capped repayments. You can never be charged more in fees than the amount of the loan you take out. For example, if you take out a £500 loan, you will never pay back more than £500 on top of the loan in interest, fees, and charges.Should I look at payday loan comparison for direct lenders only?

This is not a “yes” or “no” answer.You should always compare direct lenders if you want to get the best offer for you.If you have your mind set on applying directly with a lender, choose carefully using the table above for comparison.However, only applying directly to one lender may put you at a disadvantage. The best payday loans for bad credit are often found by using a credit broker service, such as CashLady. Applying directly to only one loan provider could put you at a disadvantage.With a broker, you complete a single application form. The broker will then take that information and share it with their panel of lenders. A panel of lenders are the credit providers a broker will introduce a borrower to.A hard credit search is not usually performed when you use a broker. The credit broker will then come back to you with an offer from a lender they believe offers the best option with the best terms.If approved and if you would like to proceed with your application, the lender will usually perform a credit search.Brokers such as CashLady do not charge a fee for their services. So when you apply through a broker, the interest charges you pay will be the same as if you had approached the lender directly.Brokers are paid by their panel of lenders for each enquiry they present.

How to compare payday loans for bad credit?

You can compare the best payday loans for bad credit by using the table above. Yet it’s important to know that each lender has their own “profile” when it comes to choosing the applicants they want to lend money to.A “profile” contains details like:

preferred credit scores

preferred spare cash at the end of each month

what level of missed payments they’re happy to accept

If you apply to many loan providers, it may take you multiple attempts to find a lender whose profile matches your circumstances.This creates another issue. Each lender will do their own credit search. The more credit searches there are on your file, the less likely a lender is to want to advance you money until your next payday. That is even if you fit their target profile.Brokers know each lender’s preferred profile. So, they will be able to send your application to the most suitable short-term credit company when they have your details.

Compare payday loans with no credit check?

Comparing payday loans with no credit check involved might seem like a sensible move but you will have trouble finding a reputable lender prepared to do this for you.You should take care only to deal with Financial Conduct Authority-licensed lenders and brokers. All of the lenders on the CashLady panel are fully authorised and regulated by the FCA.As part of their commitment to responsible lending, any licensed lender or broker must carry out credit checks as part of your application with companies like Experian and CallCredit.

Payday lender comparison – Summary

You can compare payday lenders yourself.But, it will take time and, because you can’t be sure if a lender you apply to will say “yes”, you might end up not getting the loan you need. What’s more, you will have a number of recent searches on your credit report.You can use the table showing different offers from many loan providers on this page.Or, you can apply via a broker such as CashLady to provide you with the payday loan comparison you want. These are only from the best payday lenders who are happy to have you as their customer.

advertisement please contact: : [email protected]

©2023 mortgage-payday.com All rights reserved.